How Much Are We Worth

For most readers this may be just a futile exercise in the arithmetic absolute value. Finance professionals simply say assets minus liabilities is net worth. This conceptual equation uses standardized valuation method held in a common medium referred to as currency or simply money. Parents accumulate wealth, valuables left as inheritance to their children or grandchildren. (3 Generation as seen above)

Indeed, some of us get a better appreciation for value (not money) during unusually large currency exchange fluctuation. On September 6, 2007, the Zimbabwe Dollar was devalued by 92% to an exchange rate of ZW$30,000 to US$1. These hyperinflations are marked by rapid unmanageable increases in prices. In fact, countries like Argentina, Brazil, Russia, and the US, have experienced economic crises which caused consumer prices to erase enormous value. Island countries in the Caribbean are no less susceptible to these economic paralysis periods.

For starters, we’ve just illustrated the difference between money (currency) and value in absolute terms. Let’s examine the deeper implications of economic values and the power of its dynamic nature since anything can hold value. During the previous millennia value had been held in salt, ivory, gold, silver, or rare stones. Money as coins appeared around the 6th Century BC and paper money is its contractual medium for exchange based on value conferred by governmental financial authority. Value in money or currency will vary from one economic reality to another.

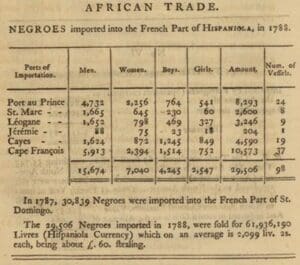

Take the industrial revolution for instance. The industrial revolution is said to have marked the sharpest increase in value for land, labor, capital, and opportunity to create or extract economic value. A recent article published by the University of Chicago challenged the undervalue of Slave Labor in the 19th century economy. “Atlantic Slave and the emergence of nineteenth century Atlantic economy” revealed “professional economic historians concluded that the employment of enslaved Africans in large-scale commodity production in the Americas, from the sixteenth to the nineteenth century, was central to the rise of the nineteenth-century Atlantic economy.” What is the impact of value extracted by US and European Superpowers from enslaved people and their descendants, even after the end of slavery?

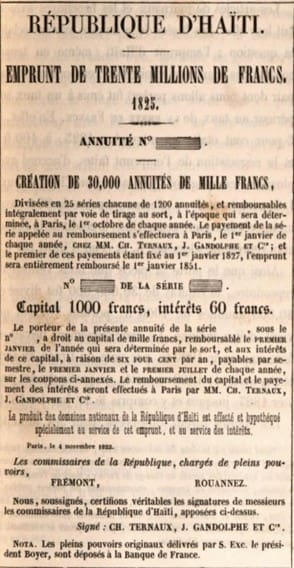

In July 1825, the French King, Charles X, sent an armed flotilla of warships to Haiti with the message to pay France 150 million francs reparation, or suffer the consequences. Based on what values? That sum was 10 times the amount the United States had paid France for the Louisiana Purchase, which had doubled the size of the U.S. (“The greatest Heist in History” NPR article published October 5, 2021 by Greg Rosalsky)

In 1849, France granted compensation to former slaveowners from the former colonies. 126 million French francs were allocated for that purpose. Nothing was ever paid to former enslaved people or descendants.

(“value” in amount paid)

After his emancipation proclamation Abraham Lincoln paid those loyal to the Union up to $300 ($8,000 in today’s Dollar) for every enslaved person, property they lost as a result. Slaveowners received value for their human properties as reparation. England doled compensation to 46,000 slaveowners at the cost of

£26.2 million. (Tera W. Hunter, The New York Times April 17, 2019.)

However, France likely extorted reparation, for loss of slaves and plantations from the Haitians for over a century making it the largest collective compensation to slaveowners and the only one paid by former enslaved. “The United States worked to isolate a newly independent Haiti during the early 19th century (…) the U.S. officially left Haiti in 1934, it continued to control Haiti’s public finances until 1947, siphoning away about 40% of Haiti’s national income to service debt repayments to the U.S. and France” according to an NPR article titled “The greatest Heist in History” and published October 5, 2021 by Greg Rosalsky on a concept coined by University of Virginia scholar Marlene Daut.

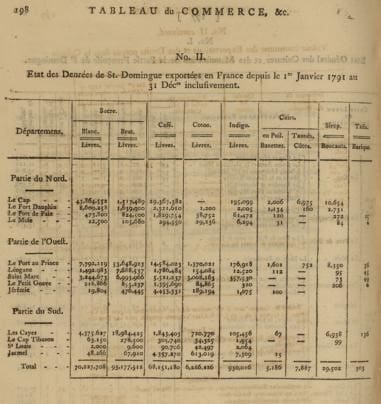

L’indemnité de 150 millions de francs est calculée sur la valeur des biens fonciers, ruraux ou citadins, des anciens propriétaires français présents dans la colonie en 1789. (…) Cependant, selon Frédérique Beauvois (…) le nombre d’esclaves (…) a été pris en compte pour déterminer la valeur des biens des planteurs. (https://esclavage-indemnites.fr/public/Base/)

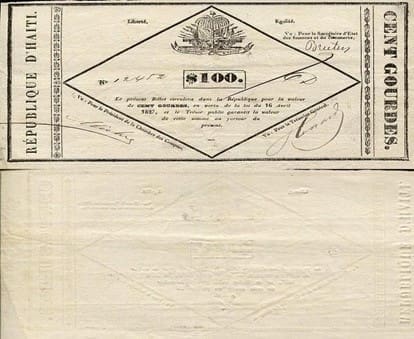

ľhe livíe was the cuííency of Haiti until 1813. ľhe Haitian livíe was a Fíench colonial cuííency, distinguished by the use, in paít, of Spanish coins.

100 Gourdes, 1827

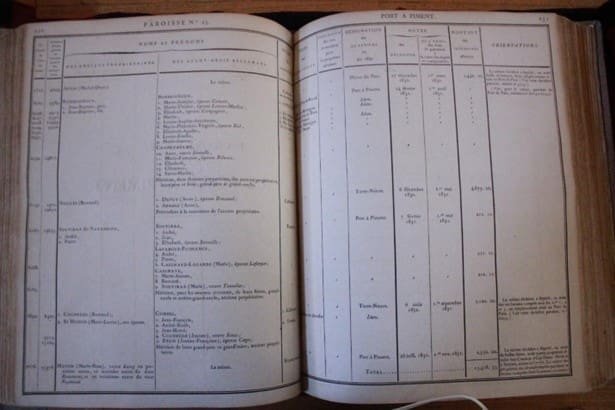

Entry page of indemnity paid to Nogues Bertrand, Anne Dupuy et Anne Abadie seen below.

Later, to meet its debt obligation the Haitian government borrowed from Crédit Industriel et Commercial. “Self-Determining Haiti.” James Weldon Johnson’s assessment of the US occupation (1915– 1934) Report published in the Nation

A Banque Nationale (of Haiti) was chartered in 1880 by the Société Générale de Crédit Industriel et Commercial and headquartered in Paris, it had agencies throughout the country, with its main branch in Port-au-Prince. It acted as the government’s treasury, maintained the republic’s schedule of debt repayment.

“Its principal banker Roger Farnham … “effectively instrumental” in initiating US (Military) intervention (in Haiti). (The Banque Nationale gold reserve was moved to Wall Street in NY by US Marines during the preliminary phase of the invasion.) (Peter James Hudson, The National City Bank of NY and Haiti 1909 – 1922) “Self-Determining Haiti: Government of, by, and for the National City Bank of New York,” Nation, September 11, 1920, 295–97

How much was that? How many billions of Dollars or Euros? Today, any perceived or real value we hold together reflects our collective consciousness, our self-perception of knowledge, wisdom, morality,

ignorance, and our self-determination to grow, to learn and improve, to mature and prosper. You must “Temet Nosce” know yourself, just as I must. That is the ultimate value of a human life.

Doley Mathurin

Managing Director, Dimension Investment Group, Strategic Real Estate Solutions Consulting