That Green paper called Money

It is said that the first money or gold coins were minted circa 550 BCE by king Croesus of Lydia in today Türkiye. But the birth of gold coin money could have been 100 years earlier. In fact, ancient Egyptians use standardized gold weights and values as means of exchange approximately 3,000 years BCE. The Persians widely use gold coinage before the Greeks, the Romans, and subsequent European powers. The quest for gold as means of value and exchange vastly expanded the known world. In the new world the first US gold coin was minted in NY in 1787.

Lydia (Turkey) Circa 600 BCE

Carthage 4th century BCE

Gold and silver coins minted and widely circulated in the new independent republic of America were dangerous to move around in large quantities and cumbersome to transport. Banks quickly became the save place to keep that valuable metal. Official bank receipts were proof of the deposit or the banks liability or debt to the owner.

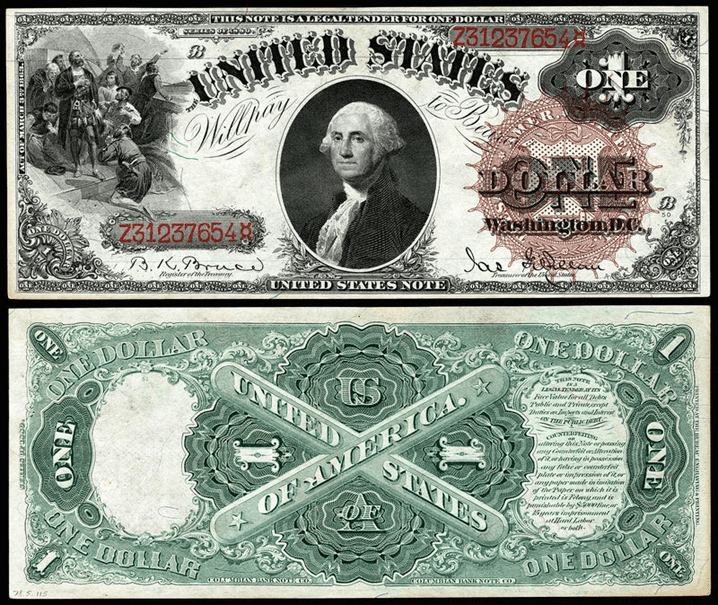

The earliest paper form of payment or paper money is believed to have been introduced in China around year 1,000. However, European banks formal Notes appeared on the financial scene in the form of square certificates about mid-17th century. Since 1792 the US government had only minted coins but thousands of paper money in the United States were printed by private banks in the in the first half of the 19th century. Historians found a fascinating page of history of money and how it worked in the US economy during that period. By this time the United States has no central bank, nothing remotely resembling today’s Federal Reserve and the US government did not “print” money. There was no nationally recognized currency of paper money. Private banks printed their own paper money or so called “Bank Notes,” a term still in use today in the 21st century.

Bank Notes were a form of “IOU” promising to pay the bearer the face value in gold. The Note was viewed as a receipt for the gold held by the bank and could be exchanged among private individuals and businesses. Bank Note Reporters magazines published listing and descriptions of the various notes in circulation, but verification or authentication was up to the receiver. Gold was already the standard around the world, especially in Europe where the City of London became the financial center of trades, money exchange and gold reserves.

By the 1840s because a State Charter was the only true requirement there was a proliferation of banks and corruption became an issue. Free Banks became de rigueur and Bank Notes from private state banks were innumerable. At one point the Chicago Tribune listed over 8,000 different “bank notes” in circulation. Anyone who wanted to open a bank would reach out to the state legislature and request approval. If approved, they would enact a specific law which grants the privilege to open your bank.

Guess who could not receive or benefit from such special approval or privilege? Over 100 years later, Rev. William Washington Browne a freed slave and union officer opened the first chartered Black-owned bank called True Reformers Bank.

Until the Civil War it had been a period of great prosperity for America, the young country. Americans thought of these pieces of paper from a bank as proof of value gold or silver, and they thought of these new paper money a receipt or a ticket, as a proof that you could claim your gold and silver. Bank Notes always featured the famous promise to pay the bearer of the note the face value of the currency note.

Because this “piece of paper” is only an IOU it still explicitly said it is not the real value. It said what the issuing bank will give in gold or silver for this Bank Note. The Paper Money became widely spread in the continent as more and more people accepted that piece of paper as means for exchange and a “stand in” for real value. The perceived tangible and durability of the value of gold has not changed for millennia. Real money worldwide was believed to be the value of the gold or silver behind the paper money.

The Civil War ushered a new euphoria in American economy as the collapse of the South coincided with the Northern states entering a new era of rapid expansion and prosperity. As the war rages on, congress passed the Legal Tender Act among other legislation to consolidate the American monetary system and give the Federal Government the authority to print and use paper money to pay its bills. The Greenback was born. The National Bank Act created a National Banking System and the IOUs or Bank Notes in circulation made way for a single National paper currency.

First US minted coin in 1787 NY

The early Dollar bill

The United States has a gold reserve of 8,200 metric tons valued at nearly 500 billion Dollars in 2023. The American banking and money system along with the global financial services industries have morphed into a behemoth ¼ of the global economy and the money sector weighing in at an estimated $80 trillion USD as reported by just 40 countries tracking this data. Only 1/10th of that number exists in the physical form of currency in circulation. Much has changed in the 20th century and today’s financial markets would be unrecognizable to a 19th century observer.

It is worthwhile to examine the progressive transformation of money during the past few decades from a physical form as a piece of paper or a coin to a bank ledger and more recently to the digital money economy. The tangibility of money has even been challenged by the advent of cryptocurrencies. Is there enough gold reserve? What happened to the gold standard? What is backing the money of today? How did the US Dollar become the leading reserve currency of the world?

(To be continued….)